Senior Living Finance: Succession Planning in Senior Living

By Lisa McCracken, Director, Senior Living Research and Development, Ziegler Investment Banking

This past month, Ziegler conducted a CFO HotlineSM poll devoted to the topic of succession planning. This topic was previously covered in 2013 and 2015, and allows for historical comparisons. Nearly 145 senior living Chief Financial Officers and financial professionals participated in the poll. The survey covered topics such as CEO tenure, anticipated times for retirement, as well as employment contracts within the C-Suite leadership team.

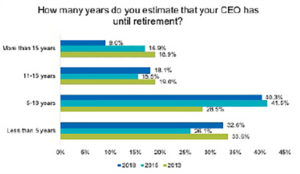

Respondents were asked to estimate how long the organization’s Chief Executive Officer (CEO) has until retirement. As shown in the chart, one-third of the respondents indicated that their CEO will likely retire in less than five years, while another 40% estimated that their CEOs will retire in the next 5 to 10 years. When looking at the next 10 years collectively, it is estimated that more than 70% of the CEOs will retire. This is up from the 68% reported in 2015 and 62% in 2013.

The survey also inquired about succession planning for future C-suite vacancies. Thirty-five percent (35%) of the organizations responded that they have a formal written succession plan in place for the CEO position. This is the same as 2015, and similar to the 39% of organizations who said they had a formal written succession plan in 2013. Multi-site organizations were more likely to have established a formal succession plan compared to single-site organizations.

The survey also inquired about succession planning for future C-suite vacancies. Thirty-five percent (35%) of the organizations responded that they have a formal written succession plan in place for the CEO position. This is the same as 2015, and similar to the 39% of organizations who said they had a formal written succession plan in 2013. Multi-site organizations were more likely to have established a formal succession plan compared to single-site organizations.

Similar succession planning questions were asked of organizations that have Chief Financial Officer (CFO) and Chief Operation Officer (COO) positions. It is estimated that roughly 18% of the CFOs will retire within the next five years, and another 43% are expected to retire in 5 to 10 years. COO retirement plans are similar in 2018 as in 2015. About 15% are expected to retire in the next five years, with another 24% anticipating retirement both in 5 to 10 years, as well as in 11 to 15 years. As in 2015, nearly four in 10 (37.3%) have more than 15 years until retirement.

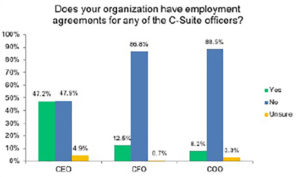

A new question for this year’s survey related to employment agreements for the C-Suite staff. While nearly half (47.2%) of those polled said their organizations have employment agreements for their CEOs, just 12.5% said they have agreements for their CFOs, and fewer than one in 10 (8.2%) said they have similar agreements for their COOs. Multi-site providers are more likely to have employment agreements than single-site organizations.

A new question for this year’s survey related to employment agreements for the C-Suite staff. While nearly half (47.2%) of those polled said their organizations have employment agreements for their CEOs, just 12.5% said they have agreements for their CFOs, and fewer than one in 10 (8.2%) said they have similar agreements for their COOs. Multi-site providers are more likely to have employment agreements than single-site organizations.

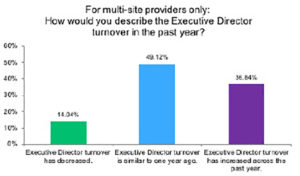

Specific to the multi-site organizations, a survey question asked about Executive Director turnover. Nearly half said that Executive Director turnover is similar to one year ago, while another 36.8% said it has increased in the past year. Less than 15% indicated that Executive Director turnover has decreased.

Specific to the multi-site organizations, a survey question asked about Executive Director turnover. Nearly half said that Executive Director turnover is similar to one year ago, while another 36.8% said it has increased in the past year. Less than 15% indicated that Executive Director turnover has decreased.

To access a copy of the full report and more detailed findings, please click here. If you have any questions regarding the Ziegler CFO HotlineSM survey or other related topics, we encourage you to reach out to the Ziegler banker in your region.

Reprinted from the monthly Z-News of Ziegler Investment Banking. Ziegler is a privately held investment bank, capital markets and proprietary investments firm. Specializing in the healthcare, senior living and education sectors, as well as general municipal and structured finance, Ziegler works to generate a positive impact on the communities it serves.

Join Our Mailing LIst

"*" indicates required fields